CA Shares 11 Lesser-Known Tax Deductions That Salaried People Miss While Filing ITR

The last date for filing income tax returns (ITR) is July 31. Here is everything you need to know before you file your taxes.

Feature Image Credit: PradeepGaurs / Shutterstock.com

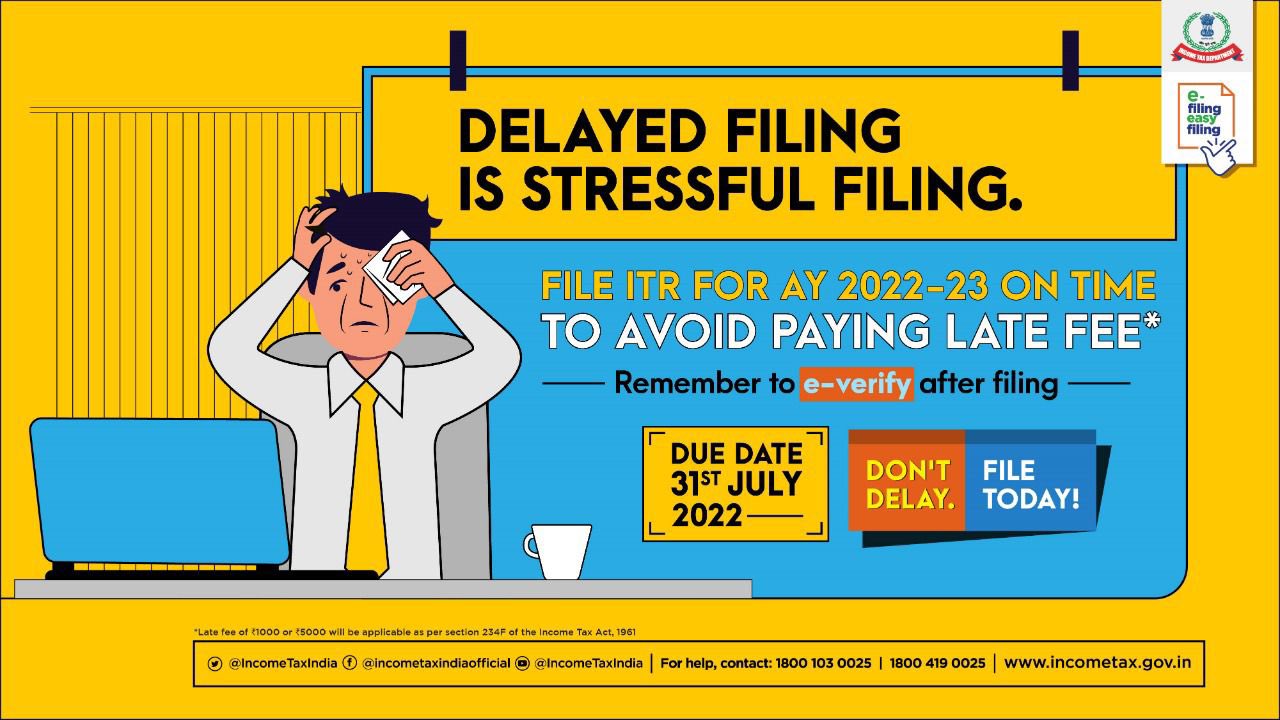

It’s that time of the year when everyone is scurrying to file their Income tax returns (ITRs) for the Financial Year (FY) 2021-22. The last date for filing income tax returns is 31 July 2022 for salaried individuals, professionals and non-auditable accounts.

The Income Tax Department has said that over 2 crore taxpayers have filed their ITR so far, and urged everyone to file their returns at the earliest. Late filing can invite a late fee.

Income Tax e-filing portal has received more than 2 crore Income Tax Returns(ITRs) for AY 2022-23.

We urge you to file your ITR at the earliest, if not filed as yet.

Pl visit: https://t.co/GYvO3n9wMf #FileNow #ITD pic.twitter.com/BvFXS5QYFG

— Income Tax India (@IncomeTaxIndia) July 20, 2022

The Better India spoke to CA Chirag Chauhan about the most important things that salaried taxpayers must remember.

Firstly, he urges people to file the returns now, as post 25 July, the portal will start hanging, and people might not be able to download a few forms.

Secondly, he speaks about the two new statements that the government rolled out last year, which will be applicable while filing taxes this year. The two new statements are called Annual Information System (AIS) and Taxpayer Information System (TIS). While taxpayers were using Form 26AS to check their other interest income etc till the last FY, AIS provides a much more detailed statement about your income from other sources/ mutual funds/share market etc.

“People filing the return by themselves must check the AIS and TIS. If you don’t check this, you will get an intimation while the return is being processed. After this, they approach CAs to solve their problem. It’s better to check it first and incorporate all the income that is shown in the AIS,” says Chauhan.

“Taxpayer Information Summary (TIS) is a category-wise aggregated information summary for a taxpayer. It shows the processed value and derived value under each information category (e.g. Salary, Interest, Dividend etc.),” he adds.

Another major difficulty encountered by people while filing the ITR is the deductions they can avail of.

In a Twitter thread, Chauhan speaks about 11 less known tax deductions that can be used.

11 hidden / unpopular / less known tax deduction or benefit Salaried Taxpayer miss while filing Income Tax Returns

— CA Chirag Chauhan (@CAChirag) July 8, 2022

1. Section 24: Interest paid on home loans taken from friends or relatives to buy a new house can be claimed.

2. Section 80D: A deduction of up to Rs 50,000 can be claimed if you pay the medical bills for your senior citizen parents who are uninsured.

2)Exemption on medical bills of uninsured parents – If you have senior citizen parents who are not covered under any insurance policy but took medical treatment, taxpayers can claim a deduction on their medical bills u/s Section 80D up to Rs 50,000

— CA Chirag Chauhan (@CAChirag) July 8, 2022

3. Section 80D: Preventive health check-ups can be claimed for up to Rs 5,000 for self, spouse and dependent kids.

4. Section 80GG: A deduction of up to Rs 60,000 can be claimed for your rent if you do not receive HRA from your employer.

4)Not receiving HRA from Employer? Can still claim rent paid deduction u/s 80GG – maximum Rs 60,000/-

— CA Chirag Chauhan (@CAChirag) July 8, 2022

5. Section 80DDB: A deduction of Rs 40,000 can be claimed for the treatment of dependents who suffer from specified diseases.

5)Taxpayer claim a deduction of Rs 40,000 if dependent who suffers from any of the ailments specified u/s 80DDB, like dementia, dystonia musculorum deformans, motor neuron disease, ataxia, chorea, hemiballismus, aphasia and Parkinson’s disease, etc

— CA Chirag Chauhan (@CAChirag) July 8, 2022

6. Section 80U/80DD: A deduction of Rs 75,000 to Rs 1,25,000 can be claimed by disabled taxpayers u/s 80U, and those with disabled dependents u/s 80DD.

7. Section 80C/CCD: A deduction of Rs 1,50,000 u/s 80 C and Rs 50,000 u/s 80CCD can be claimed by investing in National Pension System (NPS).

8. Section 80C/ 24: Here’s how you can maximise your home loan tax benefit if you are a joint home loan borrower. You can each claim Rs 1,50,000 u/s 80C for principal repayment and Rs 2,00,000 u/s 24 for interest repayment.

8)Joint home loan borrowers can claim the maximum tax benefits individually. It means each holder can get a tax rebate of Rs. 1,50,000 for principal repayment under Sec 80C and Rs. 2,00,000 for interest payment under Sec 24.

— CA Chirag Chauhan (@CAChirag) July 8, 2022

9. Hindu Undivided Family (HUF) can claim deductions under various sections as it is a separate entity.

10. Section 80G: Deductions can be claimed for donations made to registered charitable organisations or NGOs.

11. Don’t forget your capital losses: While we pay taxes on capital gains, short term or long term, you can set off your losses against the gains.

11)Taxpayer pays taxes on short term or long term capital gains, not many are aware of the fact that capital losses, if any, can be balanced off against gains.

— CA Chirag Chauhan (@CAChirag) July 8, 2022

You can use these deductions to save your tax this year or plan for tax savings next year.

Don’t forget to file your income tax return by 31 July here.

Edited by Yoshita Rao

If you found our stories insightful, informative, or even just enjoyable, we invite you to consider making a voluntary payment to support the work we do at The Better India. Your contribution helps us continue producing quality content that educates, inspires, and drives positive change.

Choose one of the payment options below for your contribution-

By paying for the stories you value, you directly contribute to sustaining our efforts focused on making a difference in the world. Together, let's ensure that impactful stories continue to be told and shared, enriching lives and communities alike.

Thank you for your support. Here are some frequently asked questions you might find helpful to know why you are contributing?